Predictive analytics solutions

Pricing & underwriting

Milliman’s predictive analytics solutions enable you to pinpoint characteristics of your best-performing—and worst-performing—customer groups, driving more insightful underwriting, pricing, and marketing decisions.

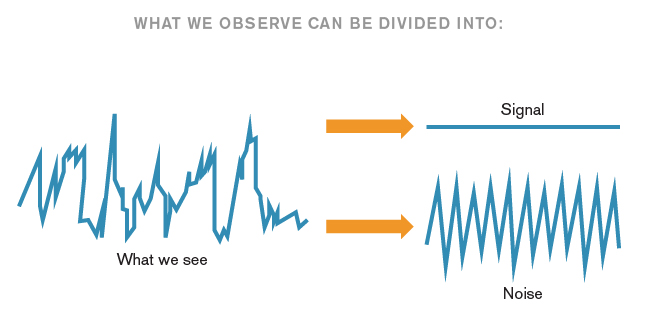

For many years, the main use of predictive modeling for insurers was to get the price “right.” But predictive modeling can be used to improve underwriting and marketing efficiency as well. The advanced techniques used by Milliman provide a means to more efficiently evaluate hundreds of variables for predictive lift and extract valuable insight from your data.

Predictive models help companies achieve business goals such as:

- Reducing loss ratios

- Improving operating efficiency

- Protecting margins in adverse underwriting and investment environments

- Improving performance of distribution/marketing systems

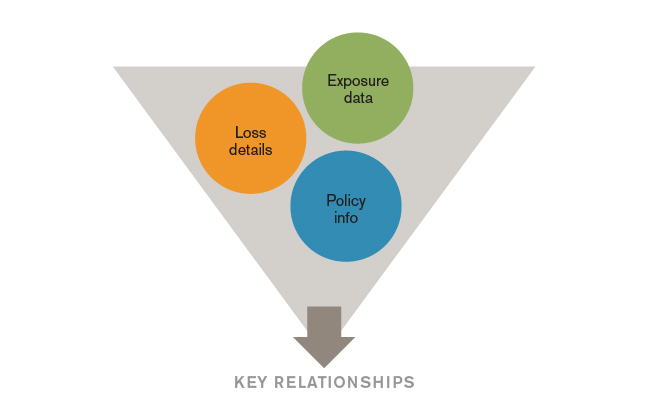

Our predictive analytics solutions are used to support actuaries and underwriters by providing a more granular view of risk and providing additional insight into historical risk and cost drivers. We can provide fact-based insight to improve pricing in multiple ways, such as:

- Refining rating plans with previously unnoticed combinations of policy characteristics

- Creating credible rating plans for submarkets

- Improving tiering structures/scores

In underwriting, predictive models create the opportunity for data-driven decisions, thereby optimizing the efficiency and effectiveness of high value personnel. For example, predictive models can be used to:

- Develop better underwriting rules

- Target certain risks for re-pricing or new business expansion

- Develop an objective basis for application of rating tiers, discounts, surcharges, or special programs

- Evaluate and monitor program, underwriter, or agent performance

- Confirm intuition of experienced professionals

- Prioritize handling of submissions based on the risk characteristics of the particular deals

- Create a “workstation” of risk variables, including corresponding thresholds and interactions available to underwriters to enhance their rating process

- Identify additional variables of value for consideration in the submission selection process

Milliman’s predictive analytic solutions can also incorporate text mining to enable more informed underwriting decisions. Text mining extracts information from unstructured text data and converts it into searchable, structured fields—making it available for statistical analysis that can drive efficient and accurate underwriting decisions.

Based on deep insurance industry knowledge and experience coupled with the latest predictive modeling methods, Milliman can help insurers get the most out of every customer relationship and provide underwriters with the tools to more efficiently and effectively underwrite risks. Milliman has helped clients use our solutions more effectively by:

- Identifying the best applications, strategic or operational, for predictive modeling

- Preparing large, structured or unstructured, datasets for analysis

- Identifying opportunities and gaps in current data to support the development of predictive modeling capabilities

- Augmenting existing data with external datasets

- Analyzing and communicating the results

- Helping management implement the results to maximize future success.

Contact us

We’re here to help you break through complex challenges and achieve next-level success.

Contact us

We’re here to help you break through complex challenges and achieve next-level success.